Getting a new job can be exciting, particularly if you’re getting a promotion or making a career change. You may be earning more money than you were in your old job and wondering how and if the change will impact your tax return when the time comes to file it.

Does changing jobs affect tax return filing? At CMP, we help our clients at every income level navigate job changes related to money management, investments, and income taxes. We’ve created this guide to help you understand what you need to do when you change jobs and its impact on your income taxes.

The Impact of Changing Jobs on Your Tax Returns

There are multiple ways in which a job change can impact your impact tax returns and the amount you end up owing.

Change in Tax Brackets

If you get a new job that pays you more than you earned in your previous job, then one of the most significant areas of impact may be that your compensation puts you in a higher tax bracket. Of course, the reverse is also a potential issue, particularly for people who are leaving a full-time job to work as independent contractors.

We suggest looking at the federal and state tax brackets to see if you are moving into a new bracket. For example, someone who was earning $90,000 per year with their previous employer who starts a new job earning $120,000 per year would move from the 22% tax bracket to the 24% tax bracket for 2023.

Altered Deductions and Credit Eligibility

Certain tax deductions and credits are tied to income levels, so an increase in your compensation may also mean that you are no longer eligible for deductions or credits you have taken in the past.

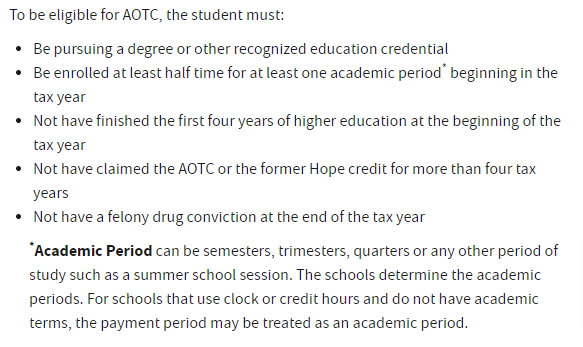

An example is the American Opportunity Tax Credit, designed to help families pay for secondary education. It’s available to single filers with a modified adjusted gross income (MAGI) of $80,000 or less. Income for married couples filing jointly must be $160,000 or less.

Impact on Retirement Account Contributions

While your income doesn’t impact the amount you may contribute to a 401(k) or a traditional IRA, it does change if you have a Roth IRA.

For 2023, the phase-out limits are as follows.

- Single: Contribution limits begin to decrease at $138,000, and you may not contribute if you earn more than $153,000.

- Married Filing Jointly: Contribution limits begin to decrease to $218,000, and you may not contribute if you earn more than $228,000.

The money you have already contributed will remain in your account, but you may not add to it if your income exceeds these limits.

New State and Local Tax Obligations

One of the biggest potential adjustments to make when changing jobs involves your state and local tax obligations. If you have moved to a new state or city for your new job, then you need to be sure that you understand your obligations and meet them accordingly.

For example, someone moving from a state that doesn’t have a state income tax to a state that does may experience sticker shock when their new employer withholds state taxes from their paycheck.

Effects on Social Security and Medicare Taxes

There are two ways that your Social Security and Medicare taxes could change as a result of switching jobs. There is an Additional Medicare Tax of 0.9% that you must pay for any individual wages paid in excess of $200,000 each calendar year. Your employer must legally withhold that money beginning in the pay period where your wages exceed the threshold.

The Social Security Tax has a wage base limit, which means that you pay taxes on income up to the limit and do not pay them for amounts over that limit. For 2023, the wage base limit is $160,200. If your annual earnings exceed that amount, your employer will stop withholding Social Security Tax after your wages reach that limit. We should also note that when you switch jobs, your new employer is required to withhold Social Security Tax until you reach the wage base, even if you have already exceeded the annual wage base with your previous employer. When you file your taxes, you will receive those withholdings back as a refund.

Unemployment Compensation Considerations

If you had a gap between leaving your old job and starting your new one, and you collected unemployment compensation, then you will need to make income tax payments on the money you received while you were unemployed.

While you have the option to have taxes withheld from your unemployment payments, the default withholding is only 10%. That may mean that you owe money based on your total compensation, and either way, you’ll need to make sure to include your unemployment income when you file your tax return.

Adjustments to Tax Withholdings

Tax withholdings are based on the W-4 form you complete when you start a new job. Withholdings are based on your filing status as well as the number of dependents you claim when you file your taxes.

If you have been required to pay additional taxes at the time of filing, it may be useful to rethink your withholding to accommodate what you owe—something that may also apply if you believe you may owe self-employment taxes or taxes on unemployment. On the flip side, anybody receiving a large tax refund may want to consider a withholding adjustment to keep money in their pockets instead of overpaying taxes.

Changes to Self-Employment Taxes

Self-employment taxes are expensive and can impact your tax filing in a number of ways. If you were self-employed as an independent contractor who moves to a full-time job, you may need to adjust your withholding to ensure you don’t owe self-employment taxes at the end of the year.

Conversely, anybody moving from full-time employment to self-employment will need to make sure to calculate and pay self-employment taxes quarterly. Failure to do so may result in late fees and penalties, which can add up quickly.

Separation Pay

You may receive compensation for unearned vacation time when you leave a job. You may also have received severance pay if you were laid off or fired. In either case, your old employer is required to withhold 22% of that payment to remit to the IRS since it is taxed as supplemental income.

The good news is that when you file your next tax return, you may be able to get some of that money back in the form of a refund. You’ll need to calculate the total amount of tax you paid and subtract the total you owe for the year to find out.

How to File Taxes If You Switch Jobs

The basic process of filing taxes doesn’t dramatically change if you switch jobs. Your former and current employer will send W-2 forms (or 1099 forms if you’re self-employed), and you will file your taxes based on that income.

You must include both your total compensation and total withholdings from both jobs. If you paid excess Social Security Tax due to the job change, you might want to hire a professional accountant to prepare your tax return and ensure that you receive the full refund to which you are entitled.

Tax Calculation for Job Change in the Same Financial Year

The process of calculating taxes when you switch jobs is relatively simple. To calculate your total taxable income, you will need to add these things:

- The total compensation you received from your previous employer.

- The total compensation you received from your current employer.

- The total unemployment compensation you received, if any.

- The total self-employment money you earned, if any.

You will use this total amount on your Form 1040 or any of its variations. You will need to do the same thing when totaling your tax withholdings.

If your new employer withheld Social Security Tax up to the wage base and you owe less than they withheld, you’ll need to subtract the amount you owe from the amount you paid based on your annual income.

Change Your Withholding as Needed

If you were self-employed and moved into full-time employment, you may want to consider increasing your withholding amount to ensure that you don’t owe taxes at the end of the tax year. For example, you could claim zero dependents to minimize your debt.

Another reason to consider changing your withholding would be if you collected unemployment and didn’t have taxes withheld or have reason to believe you will owe more than what was withheld.

Navigating the Impact of Switching Jobs

Any time you change jobs, it’s worthwhile to consider how the change will impact your taxes. The information here will help you understand how switching jobs will affect your tax return, and be sure you take advantage of any potential credits or deductions.

Do you need help preparing and filing your taxes after changing jobs? CMP has the experience to help you avoid costly mistakes and minimize the amount you owe. Contact us today to learn more about our income tax services and schedule a free consultation.