This post was originally published January 19, 2016 and extensively updated May 7, 2020.

In the world of employee benefits, 401(k) plans are considered the gold standard of retirement savings plans. They are easy for employers to manage and they allow employees the freedom to allocate their assets to the investments that they choose. Most employees, even those with little investment experience, are familiar with 401(k) plans.

At CMP, we work with many of our clients to set up and manage retirement plans. One of the most common questions we get is this:

What are 401k audit requirements?

We expect to get asked about audits, and we understand that the requirements for 401k plan audits can be difficult for employers to understand. Here is everything you need to know.

What is a 401k Audit?

A 401k audit is a review of your 401k plans by a third-party administrator (TPA). Also known as ERISA, Employee Retirement Income Security Act, 401k audits are necessary when you have over a certain number of employees actively participating in your company’s retirement plan programs.

When Must a 401k Plan Be Audited?

401(k) audits can be stressful for employers. Even hearing the word “audit” can be enough to induce panic. The truth is that 401(k) audits are a normal part of doing business and therefore, not as scary as they sound.

According to IRS rules, a 401(k) plan must be audited if it meets certain requirements as laid out by the Employee Retirement Income Security Act (ERISA). There are three questions to ask to determine if your company plan requires an audit.

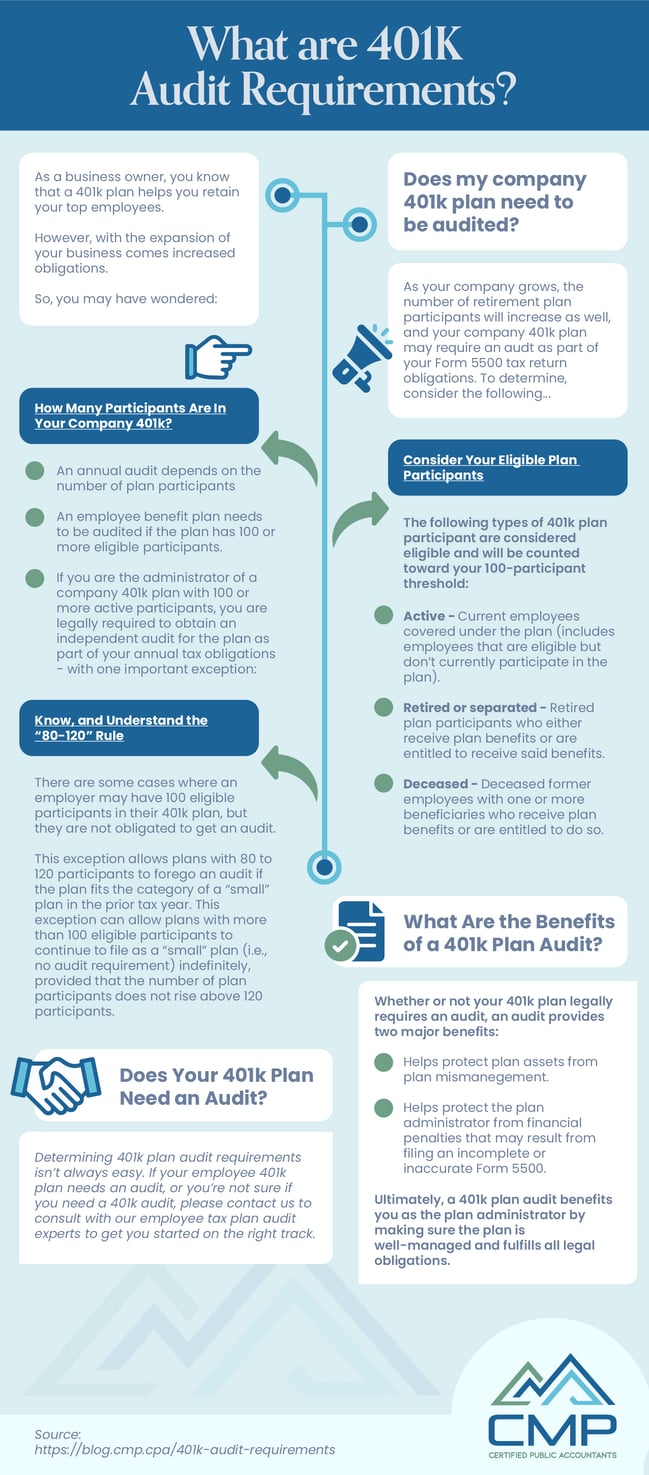

#1: How many employee participants are in your company’s 401k?

The first 401k audit requirement has to do with the number of eligible participants in your 401k plan. The short explanation is that your plan must be audited if it has 100 or more eligible participants.

When it comes to auditing employee benefit plans, the word “eligible” is important because eligible employees who choose not to participate in your 401k plan still count toward the audit requirement.

#2: Which employees are eligible for your 401k plan?

The following types of 401k plan participants are considered eligible under IRS rules and will be counted toward your 100-participant threshold for a 401(k) audit.

- Active employees. This category covers both employees currently covered under the plan as well as those who are eligible but who do not currently participate in the plan.

- Retired or separated. This category includes retired plan participants who either receive plan benefits or are eligible to receive said benefits. It also includes employees who have left your employ but still have active plans with you.

- Deceased. This category includes deceased former employees with one or more beneficiaries who receive plan benefits or are entitled to receive plan benefits.

Eligible employees are counted if they fall into one of the above categories as of the end of the prior tax year.

#3: Does your company fall into the 80-120 rule?

There are some cases where an employer may have 100 or more eligible participants in their 401k plan, but they are not obligated to get an audit.

This exception allows plans with 80 to 120 participants to forego an audit if the plan fits the category of a “small” plan in the prior tax year. This exception can allow plans with more than 100 eligible participants to continue to file as a “small” plan (i.e., no audit requirement) indefinitely, provided that the number of plan participants does not rise above 120 participants.

So, for example, if your plan had 75 eligible participants in 2017, 105 participants at the beginning of the 2018 tax year, and 118 at the beginning of the 2019 tax year, you could continue to file as a small plan for 2019.

Download Your Free Checklist: Bulletproof Your 401(k) Plans!

How Much Does a 401(k) Audit Cost?

If your company’s retirement plan meets the 401k audit requirements as set out by ERISA, then you must hire a third-party administrator (TPA) to carry out the audit. At CMP, we conduct 401k audits on a regular basis.

The cost of a 401(k) audit is difficult to predict since it depends largely on the size of the 401(k) plan being audited and the complexities of the situation. The third-party administrator you hire should assess the situation and what it requires and provide a quote that’s commensurate with the job.

We work closely with our 401(k) audit clients to arrive at a quote for the audit and explain it. We will be happy to discuss your audit needs with you.

How Do I Prepare for a 401k Audit?

If you determine that your company plan meets the 401k audit requirements, then you must prepare for the audit itself. Here are the steps to follow.

- Hire a TPA to conduct the audit. You may not substitute an internal audit for an audit conducted by a TPA.

- Get a list of the auditor’s requirements.

- Gather your documents. Some of the items required will include plan documents, payroll records, and time-stamped communications related to the administration of your 401(k) plan.

You can make future audits easier by partnering with a fiduciary to administer your retirement plan. A fiduciary will help you comply with regulatory requirements and minimize the risk of future audits revealing problems with your plan.

401k Audit Preparation Checklist

We understand that preparing for an audit can feel like an overwhelming task. We’ve created this easy-reference checklist to help you gather the required documentation for a smooth audit. Here’s what you will need.

- An audit package with year-end reports for plan records.

- A certification letter from the plan custodian or trustee. (This can reduce the scope of audit procedures if a bank or insurance company certifies that the year-end reports are accurate and complete.)

- A draft of IRS Form 5500.

- Plan compliance testing results.

- Plan activity occurring after the end of the plan year.

- Written 401k plan documents and internal controls.

- Contribution, rollover, and forfeiture information.

- Documentation of cash and investments related to the plan.

- Benefits payable and expenses.

- Compliance documentation.

Your best option is to work with an experienced CPA firm to help you prepare for the audit. At CMP, we work closely with our clients to help them prepare and gather the necessary documentation. In our role as a TPA, we provide our audit clients with a detailed checklist explaining what we need to complete the audit as quickly and painlessly as possible.

How to Choose a TPA for Your 401k Audit

If you want to have an uneventful audit, you must hire the right TPA to complete the audit. Here are some pointers for choosing the right TPA.

- Ask about the TPA’s auditing experience and make sure they have experience with auditing plans like yours.

- Get information about their pricing structure and how much it will cost to conduct the audit.

- Ask for references and call them before you sign a contract.

Your TPA is the one who will prepare your audit for the IRS to review. It’s essential to choose a company with the right experience.

How to Set Up a 401k Plan for Your Business

Setting up a 401k plan for your employees is relatively easy. And if you work with retirement plan experts like CMP, you’ll have a plan ready to share with your employees in no time.

There are a lot of choices out there when it comes to retirement plans such as the following:

- 403(b)’s (also known as tax-sheltered annuity (TSA) plans)

- profit sharing plans

- cash balance plans

- multiple employer plans and more

Working with retirement plan experts can help you understand the pros and cons of each and determine what is right for your organization.

Conclusion

401k plan audit requirements may be detailed and difficult to understand. The key to having a smooth audit process is to administer your plan properly and partner with an experienced TPA for the audit.

Need a TPA to complete your 401k plan audit? Click the button below to learn how CMP can help!